Manufacturers in Nigeria’s consumer goods sector are struggling with a sharp rise in input costs driven by inflation, with eight firms analyzed by Dip Connects News recording an 85.7% surge to N3.12 trillion in 2024.

Analysts link the rising costs to inflationary pressures, which have caused input prices to nearly double in the past year. Nigeria’s headline inflation edged up to 34.8% in December 2024 from 34.6% in December 2023, according to the National Bureau of Statistics. Increased demand during the festive season further fueled inflation.

Consumer goods firms are facing soaring raw material costs, worsened by naira depreciation, which has led to higher production expenses. “The double-digit inflation and currency volatility in 2024 have significantly impacted earnings, particularly for companies reliant on imported raw materials,” said Kayode Eseyin, lead consumer goods and agriculture analyst at CardinalStone Securities.

Eseyin added that with expectations of lower inflation and a more stable FX market in 2025, cost pressures may ease. However, firms that have invested in supply chain risk management and backward integration stand to benefit the most.

An analysis of five consumer goods firms reporting raw material costs in their financial statements showed a cumulative 99% year-on-year increase in 2024.

Escalating raw material prices and supply shortages have created logistical challenges, further straining profitability.

Rising Costs Across Major Firms

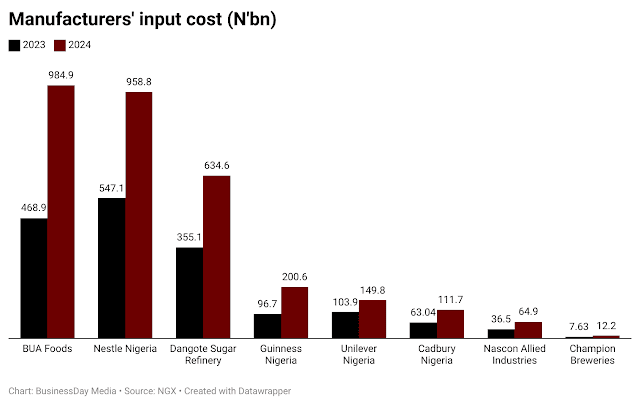

Several leading consumer goods companies saw sharp increases in input costs:

-

BUA Foods: N984.9 billion (up from N468.9 billion)

-

Nestlé Nigeria: N958.8 billion (up from N547.1 billion)

-

Dangote Sugar Refinery: N634.6 billion (up from N355.1 billion)

-

Guinness Nigeria: N200.6 billion (up from N96.7 billion)

-

Unilever Nigeria: N149.8 billion (up from N103.9 billion)

-

Cadbury Nigeria: N111.7 billion (up from N63.04 billion)

-

Nascon Allied Industries: N64.9 billion (up from N36.5 billion)

-

Champion Breweries: N12.2 billion (up from N7.63 billion)

Despite these challenges, some company executives remain optimistic. BUA Foods’ Managing Director, Ayodele Abioye, highlighted the company’s ability to navigate challenges and create value. “Despite significant macroeconomic difficulties, our business effectively managed supply chain costs and foreign exchange losses,” he said.

Nestlé Nigeria’s Managing Director, Wassim Elhusseini, echoed this sentiment, noting that despite a tough business environment, the company recorded a 75.2% revenue growth and a 35.6% improvement in operating profit to N167.9 billion. However, high finance costs linked to naira devaluation impacted net profit. “Our Q4 2024 results mark a return to profitability, with a net profit of N19.7 billion, against a loss of N36.4 billion in Q4 2023,” he said.

The Impact on Manufacturing

Since 2020, Nigerian manufacturers have battled rising operational costs due to insecurity, naira depreciation, and supply chain disruptions from the COVID-19 pandemic. The increasing cost of raw material imports in 2024 highlights the slow pace of backward integration, leaving firms vulnerable to forex fluctuations.

With input costs outpacing sales growth, manufacturers are reassessing pricing strategies to maintain profitability. Unilever Nigeria’s Managing Director, Tobi Adeniyi, said the company remains committed to serving consumers efficiently, emphasizing operational efficiency, cost optimization, and market expansion.

Similarly, Nigerian Breweries’ CEO, Hans Essaadi, noted that strategic pricing, market expansion, and cost management helped boost group operating profit by 54% despite macroeconomic challenges.

The Need for Local Sourcing

Analysts recommend that firms increase local sourcing of raw materials to reduce reliance on imports. “Consumer goods firms should focus on made-in-Nigeria raw products, which are cheaper than imports. They should also cut waste, reduce excess inventory, and downsize if necessary,” said Professor Uzo Uchenna of Lagos Business School.

If manufacturers fail to pass rising costs onto consumers, profitability could remain under pressure, potentially slowing industry growth in the long term.